Filling Guide

- 7 December 2022

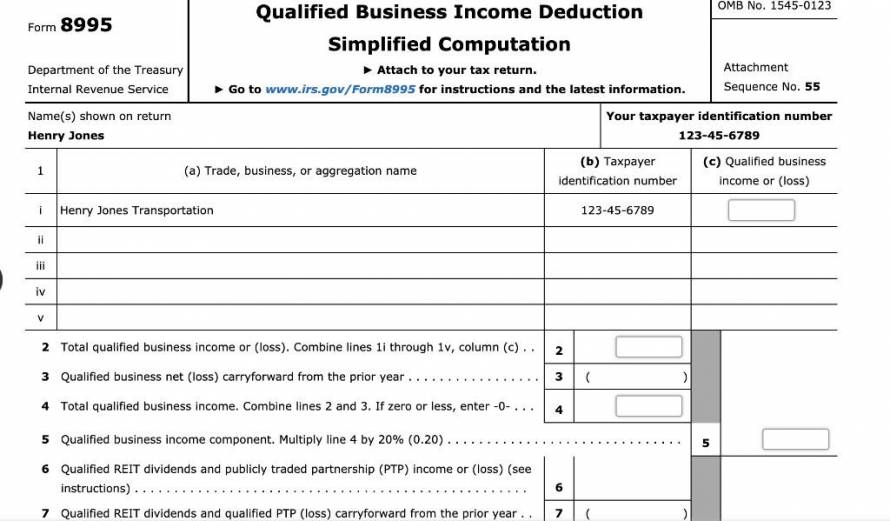

First, you need to fill in your personal information including your name, address, and social security number. Next, you need to select the type of expenses you are claiming. For example, if you are claiming unreimbursed employee business expenses, you will need to provide the total amount of business expenses (line 23) and the total amount of miscellaneous itemized deductions (line 27) you are claiming. If you are claiming, for example, unreimbursed employee business expenses of $5,000 and miscellaneous itemized deductions of $6,000, you would fill in the corresponding fields in the form, which are line 23 and line 27, with the corresponding information.

Lastly, you would sign the form and include your date of birth, the date on which you are signing, and your social security number and send this form.