Printable Form 8995

- 1 December 2022

8995 Form is a document that is filed with your income tax return to report a summary of health care coverage. The total cost of the coverage, any advance payments of the premium tax credit, and any repayments of the advance payments are reported on this form.

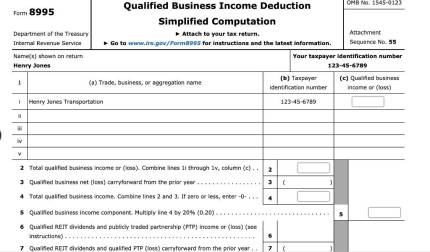

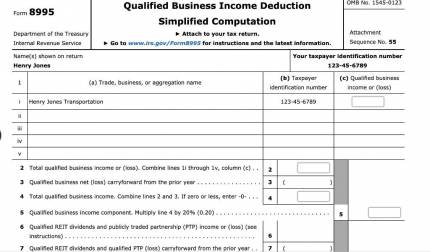

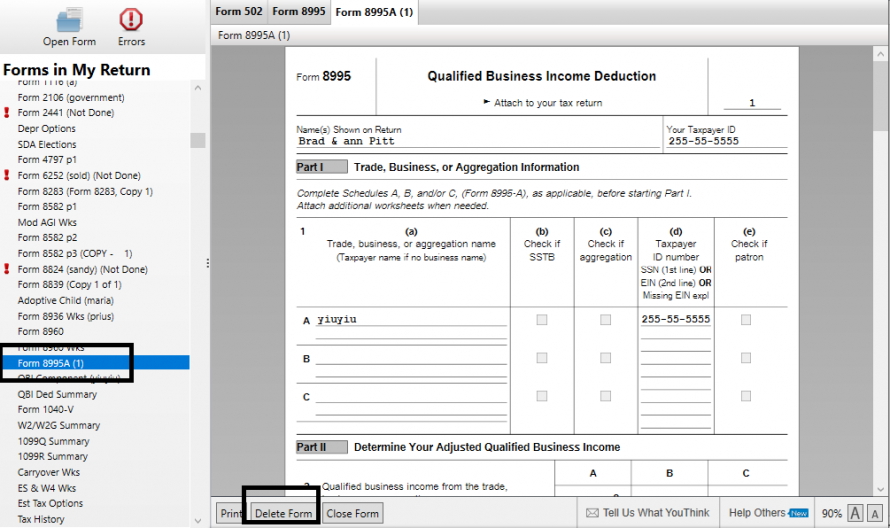

- What is the meaning of Form 8995?

Form 8995 printable is a form filed in the US Internal Revenue Service (IRS) in order to file a detailed account of the calculation of the Taxable Medical Savings Account (MSA) for an individual. - Whom does Form 8995 affect?

Form 8995 is designed to be filed by individuals.