Online Form 8995

- 6 December 2022

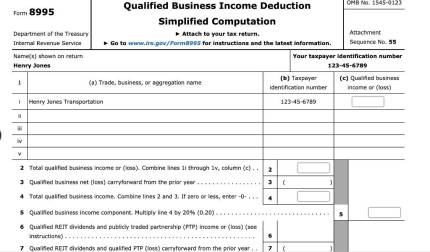

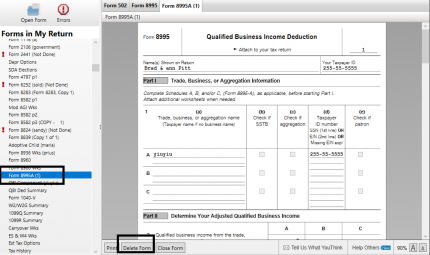

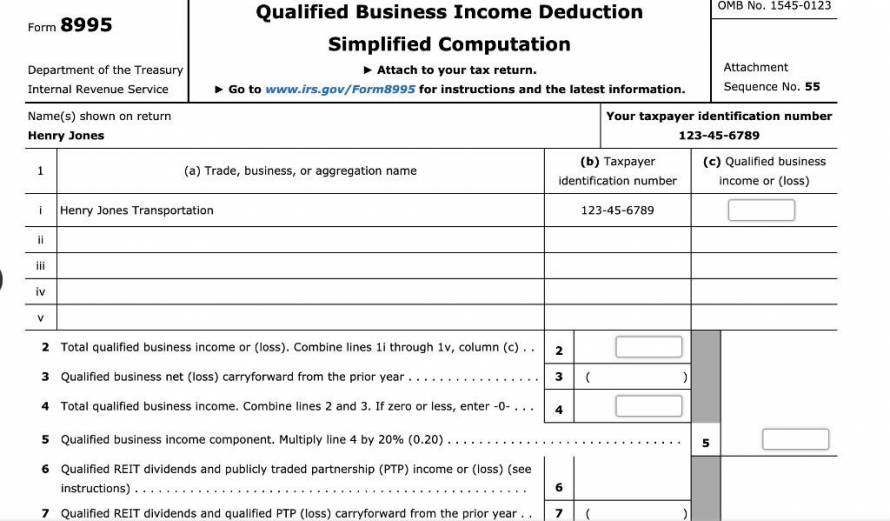

Form 8995 is a form that is filed with the Internal Revenue Service (IRS) and it is used to provide details about an employee's qualified retirement plan benefits. This form is filed by employers and provides data to the IRS and the plan participant. Form 8995 is used to calculate the total cost to an employer for providing qualified retirement plan benefits. Any excess contributions made by the employer are also shown on this form.

- What is an 8995 form online?

An 8995 is a form that is used to tell the IRS that a taxpayer is purchasing a health care policy from an insurance company that provides a tax exclusion. - Who can fill out an 8995?

An 8995 is used by the taxpayer to fill out the form. - When do you use an 8995 online?

An 8995 is used to tell the IRS about a taxpayer purchasing a health care policy.