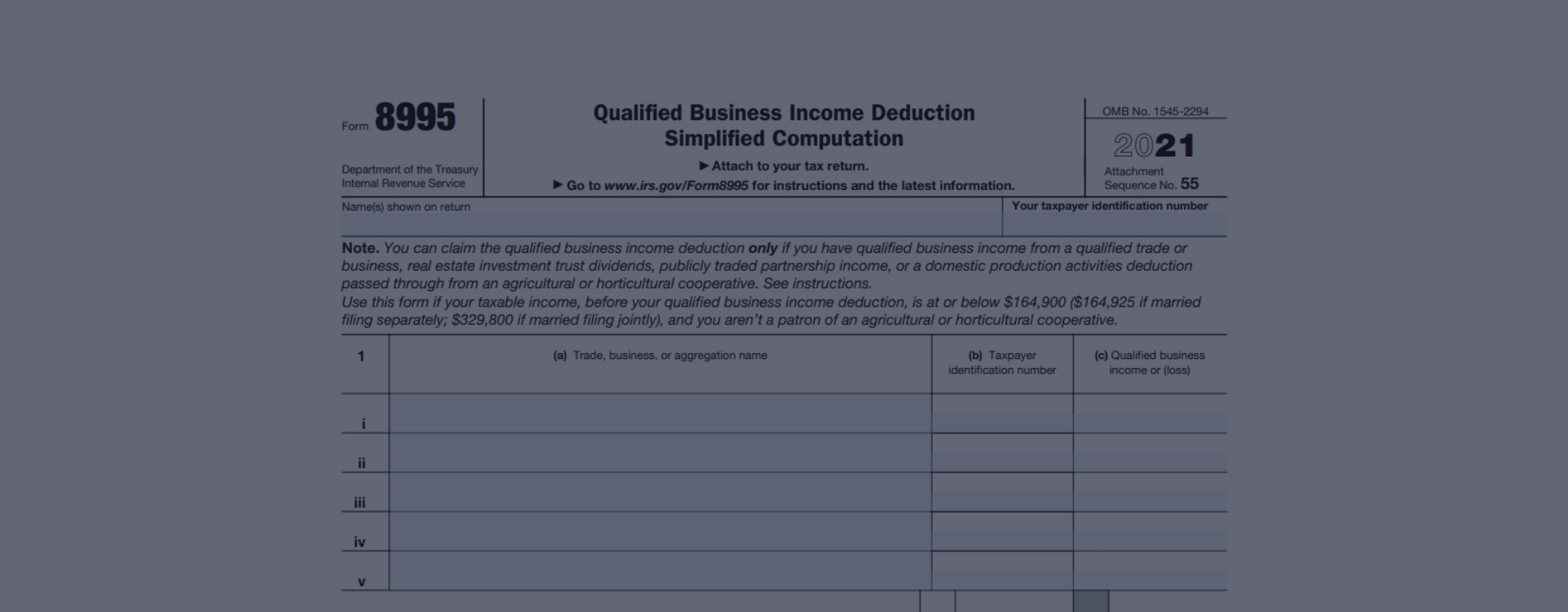

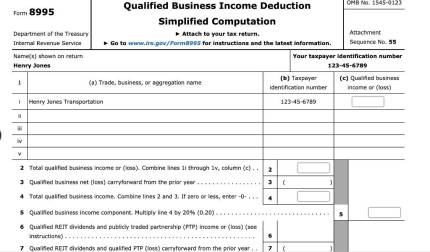

Qualified Business Income Deduction

Form 8995 is a document submitted with the tax return to show the amount of taxes owed on health coverage benefits. IRS 8995 with instructions can be completed if the taxpayer was offered employer-sponsored health coverage, but decided not to accept it. If the taxpayer was offered coverage, but turned it down, they may have to pay the full amount of the taxes owed on the benefits they received.

This document is needed in order to report the amount of income that the taxpayer has earned from the foreign corporation and to disclose the income that will be subject to tax. IRS Form 8995 and the form 1065 (U.S. Return of Partnership Income) must be filed on the same day.

- The taxpayer should report the income from a foreign corporation that is not a specified foreign corporation on Form 8995 with instructions 2022 if the income is not subject to tax as it is not listed as a dividend, contribution to capital, loan, or loan guarantee.

- The taxpayer should file this document on or before the date that they file their income tax return.

- The taxpayer should use Form 8995 2022 if the taxpayer does not have to report the income on document.

- The taxpayer should also use documents if the taxpayer is claiming the foreign tax credit.

- The taxpayer should use this document to report any income that may be subject to U.S. tax and not to report any income that is not subject to U.S. tax.

Tax Form 8995: Online Filling

Form should be used to report any contributions to specified foreign corporations. The taxpayer should use IRS Form 8995 with instructions if the taxpayer has a branch or a subsidiary in a foreign country. The taxpayer has to use document to report certain transactions to a foreign corporation.

Fill FormWhy Do You Need Printable Form 8995?

It is a document for financial professionals and tax preparers to disclose the dollar amount of federal income tax and other taxes paid by the client. It is used to calculate the taxpayer's total tax liability. Document is also used to estimate the taxpayer's potential refund.

The income taxes that are reported on this document are taxes that are deducted from paychecks, taxes withheld on income, and taxes withheld on certain types of investment income.

List of taxes to be reported:

- Income tax

- Social Security and Medicare tax

- From wages

- From pensions

- From unemployment compensation

- From gambling winnings

- From interest and dividends

- From other income

For Who?

The IRS requires that any person acquiring, by purchase or otherwise, any interest in the assets of a charitable or educational organization, or of a corporation or trust, or of a partnership that, within the preceding 5 years, has ceased to operate, must file 8990.

If you are considering filing Form 8990, it is important to consult with an attorney who is knowledgeable in this area. They can answer any questions that you may have.

Organizations with at least $5,000 in unrelated business revenue, gross receipts, deductions, or credits, or companies with at least $5,000 in gross income from interest, dividends, or annuities, are required to file Form 8995 example. Organizations who do not meet these criteria are not required to file document.

Please Note

This website (8995form.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.

Frequently Asked Questions

- What is the IRS Form 8995 PDF?Health Insurance and Other Benefits document is a form that taxpayers can use to report the health care related information on their taxes. It’s also known as the “Unreimbursed Health Care Expenses”.

- Why should I use the Tax Form 8995 2022?It is used to report health care expenses that were not reimbursed by insurance. Health care expenses include things like copays, prescriptions, dental work, and medical equipment.

- Why should taxpayers complete Form 8995?It is useful for taxpayers to complete documents if they are in possession of a Qualified Retirement Plan in order to determine the taxable amount of plan distribution.

- How does Federal Tax Form 8995 work in the tax return?It is used in the tax return to calculate the taxable portion of the plan distribution.

The Latest News

Filling Guide First, you need to fill in your personal information including your name, address, and social security number. Next, you need to select the type of expenses you are claiming. For example, if you are claiming unreimbursed employee business expenses, you will need to provide the total amount of busine...

Filling Guide First, you need to fill in your personal information including your name, address, and social security number. Next, you need to select the type of expenses you are claiming. For example, if you are claiming unreimbursed employee business expenses, you will need to provide the total amount of busine... - 7 December, 2022

- Online Form 8995 Form 8995 is a form that is filed with the Internal Revenue Service (IRS) and it is used to provide details about an employee's qualified retirement plan benefits. This form is filed by employers and provides data to the IRS and the plan participant. Form 8995 is used to calculate the total cost to...

- 6 December, 2022

- Printable Form 8995 8995 Form is a document that is filed with your income tax return to report a summary of health care coverage. The total cost of the coverage, any advance payments of the premium tax credit, and any repayments of the advance payments are reported on this form. What is the meaning of Form 8995?For...

- 1 December, 2022